By Dr Sanjay Murari Chaturvedi, LLB, PhD

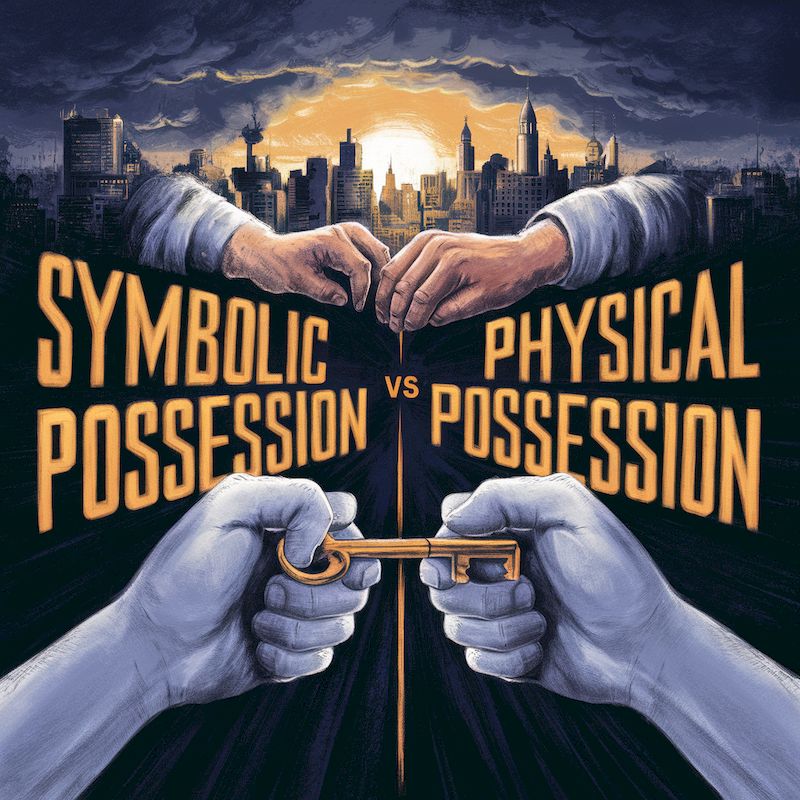

When banks, Non-Banking Financial Companies (NBFCs), or Asset Reconstruction Companies (ARCs) advertise properties under Non-Performing Assets (NPA), they often categorize possession as either “Symbolic” or “Physical.” Understanding these terms is crucial for buyers, as each carries different implications, especially when purchasing auctioned properties.

What is Symbolic Possession?

Symbolic possession refers to cases where the bank or financial institution does not have direct physical control over the property. Instead, it has a legal claim but not physical occupancy. Properties listed under symbolic possession are typically offered on an “As Is, Where Is” basis. This means the bank does not guarantee a clear title or assume responsibility for transferring physical control of the property to the buyer.

Properties under symbolic possession can carry significant risk. If a third party—such as a tenant, former owner, or even someone occupying the property unlawfully—holds the property, the successful bidder may face challenges. In such cases, they might need to file a civil suit to evict the occupant, which could be a lengthy and uncertain process. Additionally, properties under symbolic possession might have legal encumbrances, such as liens or attachments from agencies like the Enforcement Directorate (ED) or the Income Tax Department, which complicate ownership further.

What is Physical Possession?

Physical possession, on the other hand, means the financial institution has direct control of the property and can hand it over to the buyer after the auction. While physical possession provides a sense of security, due diligence is still essential. There have been instances where auctioneers have not fully disclosed statutory encumbrances, even though they are legally required to advertise these details.

Before purchasing a property under physical possession, inspecting it personally is advisable. Physical possession does not guarantee a clear title or eliminate all risks; however, it generally involves fewer complications compared to symbolic possession.

Key Considerations for Buyers

- Due Diligence: Whether a property is under symbolic or physical possession, thorough due diligence is essential. Check for any hidden legal issues or encumbrances.

- Inspection: Always inspect the property physically. A site visit provides firsthand insight into the property’s condition and occupancy status.

- Legal Advice: Consult a real estate lawyer to assess the risks and implications of purchasing an NPA property, especially under symbolic possession.

The Real Estate Rule: “Kabja Sachha, Jhagada Jhuta”

A famous adage in real estate states, “Kabja Sachha, Jhagada Jhuta,” which means the person occupying a property is seen as the prima facie owner. The burden lies on anyone else claiming ownership to provide proof. This principle highlights the importance of securing physical possession before finalizing any property transaction.

Conclusion

In property auctions, understanding the difference between symbolic and physical possession is vital. Symbolic possession may come with significant legal hurdles, while physical possession offers more straightforward ownership transfer but still requires due diligence. For a smoother and more secure property acquisition, buyers should prioritize properties with physical possession and seek legal advice.